Authored by: Malay Chitalia

Concept & Inspiration: Resp. R. Gopinath

I have come across this question very often that “Where should we invest our hard earned money? Which is the best product to invest so that we get safety of capital along with good rate of return?” This is the question of majority of people. At present, there are more than 21000 financial instruments (products) available in India. “Which one is the right product for me?” is the biggest question.

There are some people who are over-cautious and are reluctant to invest into Equity market and other high yielding products. There are other class of people who are highly influenced by the biased talk shows on TV channels and articles of celebrity fund managers in newspapers. They blindly invest in to Equities and Mutual Fund without any rational thinking. The question is which is the right market or the product to invest our hard earned money which provides good returns along with security of the capital.

I was highly inspired by the concept “Financial Pyramid” by Mr. R. Gopinath when he introduced this concept at one of the training sessions.

(Mr. R. Gopinath is a Prominent Researcher in Financial Planning, a visionary of Insurance Industry, a well-known Speaker, EX MD & CEO of LIC, Sri Lanka and Founder of Go-Past Institute)

I must share this concept with all my valued customers, family and friends so that they can select their best option to invest without over exposing themselves to the risk; at the same time they don’t underutilize their resources by taking ‘over-cautious’ stand while investing.

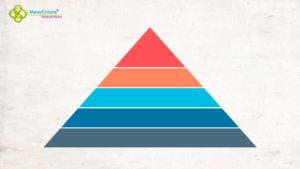

The Pyramid: The “Pyramid” is the most stable and the most reliable structure in the world. It is always constructed bottom up. It has wide base and relatively narrow upper sections.

We all have visited our ancient temples. Some of them are more than 6000 years old. How they have survived the test of time? Thanks to their structure. Few years back there was tragedy near Holy Kedarnath temple in Uttarakhand, Northern India. All surrounding structures were washed away by the powerful floods; only the Holy Temple survived. Reasons can be para-natural also, but one of the reasons could be its ‘pyramid-structure’ which stood tall against the mighty floods.

We all know about the Pyramids of Egypt. They are surviving since last 4000 years. Again due to the design of its structure.

What applies to the Civil Engineering that applies to the Science of Finance also. The below image describes how your Financial Pyramid should be.

Protection: This level is the base of your finance. This level of pyramid refers to the financial products that offers protection of income. These type of financial products ensures that even though your income stops due to any disasters like Accidental disability, Critical illnesses or Death, you and your family continue receiving income. The products that will appear at this level of pyramid are Life Insurance, Critical illness Insurance, Accidental Death and Disability Insurance. These products protects your earning capacity.

Today, we all are crazy behind ROI (Rate of Interest), IRR (Internal Rate of Return). The ROI and IRR comes in to the picture when there is a spear money to invest. The spear money only comes when there is a flow of steady income. The “Capacity to Earn” is the main source of Income. This is our primary duty to insure our own “Earning Capacity” in order to secure the source of income. The people who are overlooking this aspect and investing blindly to earn higher ROI without insuring themselves adequately, may have to suffer a lot. The base shown in the image is the widest, it means your money going towards securing the insurance for yourself should be the highest as compared to other upper levels.

Risk Free Growth: This level of pyramid offers safety of the money saved for your future. The financial products under this level provide holding capacity during turbulent times. These products are meant to be encashed at a short notice. The products under this level are Bank Fixed Deposits, Postal Saving Schemes, PPF, Government Bonds and Life Insurance Saving Plans (which offers saving element along with insurance protection).

The life is like a graph of ECG. Sometimes it’s movement is upward; sometimes it is downwards. When the graph shows downward movement; these products play a vital role. It increases your holding capacity and shock absorbing capacity and plays a major role to bring the situation back to normal.

Growth with Risk: The products which comes under this level carries an element of risk on the capital invested along with an expectation to earn high yield on the amount invested. These type of products are an answer to the inflation. At the same time, we must understand that the capital invested in these products are subject to the risk of diminishing or even complete consumption of capital during volatile times.

Then the question is why we should invest in to these products. We must invest in these plans because “Not taking risk at all is the biggest risk one takes in his life.” The purpose of investing in such products are to meet the big expenses & commitment in life and to keep up your wealth in accordance with the inflation. By and large long term investment in such products reduces the risk involved and give good returns as they perform in cycles. The products that comes under this level are Mutual Funds, ULIPs, Equities, Metals (Gold, Silver etc.), Commodities & Currencies.

High Growth: This refers to financial products which require huge amounts to be invested. These products also carry the risk on the capital invested with a hope of getting more yield on the money invested, just like the products at the “Growth with Risk” stage.

Since the capital invested is huge, investors get carried away by the big volumes of sale of the assets and generally there is a myth that they yield a very high Rate Of Interest (30%+).

The products which appear at this stage of the pyramid are: Real Estate, Venture Capital investments, Big Solitaire diamonds, highly priced art and antique pieces.

Speculation: Speculation in normal terms mean “Thinking”. Financial instruments keep getting different prices at different times. When a person thinks about these movements and takes a position either to buy or to sell at a particular price at a particular time; that decision is called speculation. Mostly these instruments are held for a short term period. However some investors keep trading for a long term by sell/buy/sell and absorb the losses in-between through a few big gains made over a period. Short term or long term, these investors take big risk here, they provide at times 5X margin money to trade for X amount. Products like Derivatives, F&O and Swaps are examples of speculative products.

The bottom two levels (Protection & Risk Free Growth) of the pyramid provide the holding capacity and therefore increase the risk absorbing strength to the investor so that he can truly benefit from the higher parts of the pyramid. But people who do not provide adequate amounts in the first two stages of the pyramid, so as to earn more ROI on the whole portfolio generally loose heavily.

Each stage in the image of Financial Pyramid refers the volume of the money to be invested. The base level ‘Protection’ is covering highest area of the pyramid. It means that your Life Insurance, Personal Accident and Disability Insurance, Critical Illness Insurance should occupy the adequate amount. Without buying an adequate insurance, one should not go to the next level which is “Risk Free Growth”.

(“What is the Adequate Insurance amount for me?” is the subjective question and would love to cover it in one of my articles. Still I would recommend to consult your Professional Insurance Adviser to know your “Adequate Insurance amount”)

As discussed earlier, the products in 2nd level “Risk Free Growth” may provide you decent (not very high, not very low) Rate of Interest (say 5% to 7%), but their purpose is to provide you holding capacity during bad times. So here also you should have an adequate amount of investment.

The people who do not provide adequately and jump to the 3rd and 4th level to earn maximum returns are taking irrational risk with their lives and may have to suffer the consequences.

“There are 8 principles which governs Wealth Management. The people who have violated these principles have lost their wealth. Those who obeys these principles will have wealth for generations to come.”

– R. Gopinath

5 Responses

Good analysis and very true. It is indeed helpful. Thank you very much.

Nicely explained the pyramid in investment terms. Great going malay. Enrich us with auch topics. Cheers…

Thank you so much Sameerbhai..

Superb Malay.

Keep it up.

Thanks.

Vipul jhaveri

Thanks Vipulbhai